Mortgage points break even calculator

The annual percentage rate APR on a mortgage is a better indication of the true cost of a home loan than the mortgage interest rate by itself. This is when you compare your refinance savings to how much it costs to do the refi.

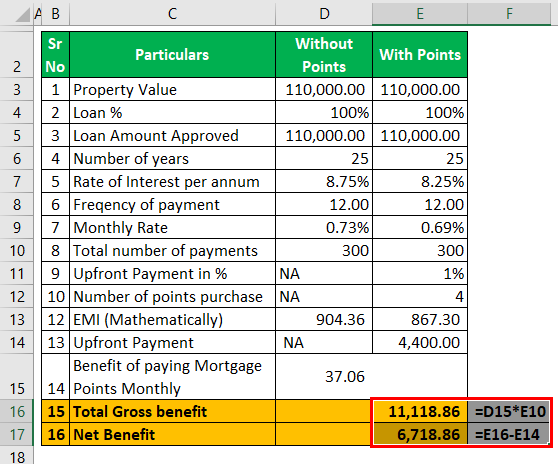

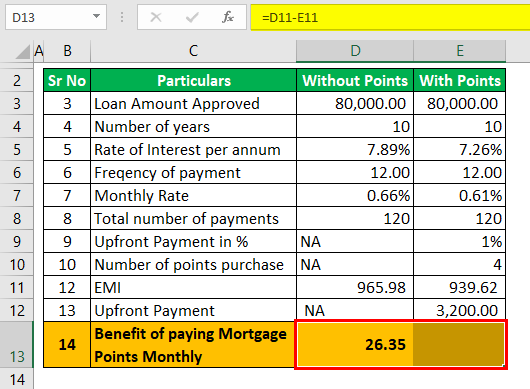

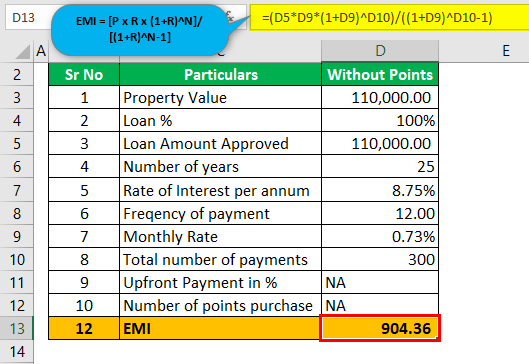

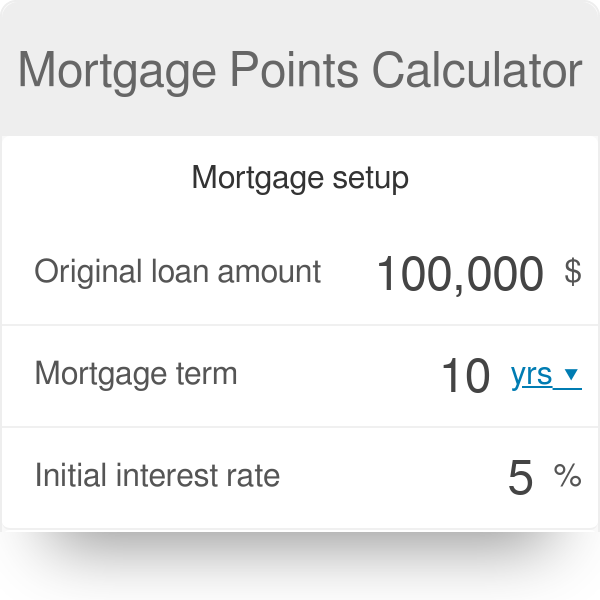

Mortgage Points Calculator Calculate Emi With Without Points

To use our mortgage calculator slide the adjusters to fit your financial situation.

. For example if it takes 68 months to hit your break-even point you would have a little more than 24 years left on a 30-year mortgage. Mortgage Points Calculator - If you are thinking of buying discount mortgage points to reduce your interest rate and monthly payments check out the mortgage points calculator. Instead of making a 60000 down payment youll owe a 9000 down payment.

The APR takes into account not only the mortgage rate but also things like closing costs discount points and other fees that are. Refinancing includes closing costs that are about 36 of the loan amount. Along with our writing editing and proofreading skills we ensure you get real value for your money hence the reason we add these extra features to our homework help service at no extra cost.

Break-even point BEP Cost of points Amount in monthly savings Using our previous example above lets see how long it will take to break-even on your investment. Living in the same home for over 4 years is common so buying points which break even in 4 years is not a bad idea. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates the best lenders navigating the homebuying process refinancing your mortgage and more. Buying points on mortgages with only a few years left or on those with already very low mortgage rates could yield monthly savings of only a few bucks and never reach a break-even point for your. The break-even point is crucial because it helps borrowers determine whether the refinance.

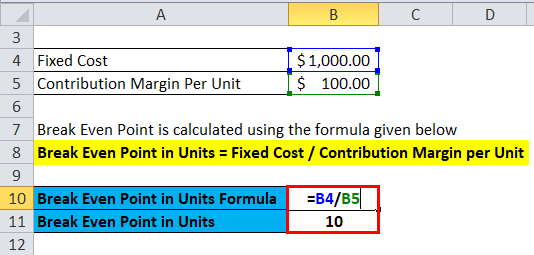

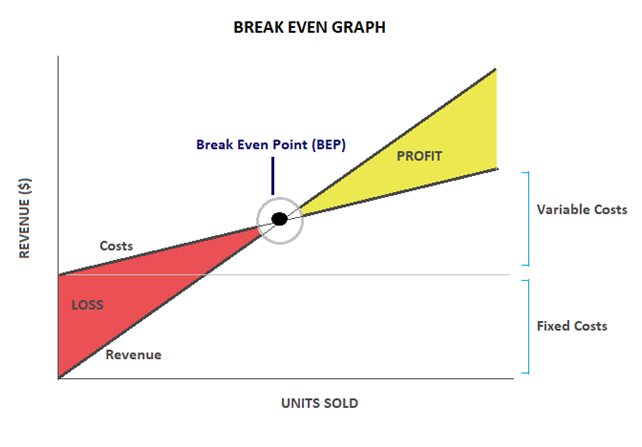

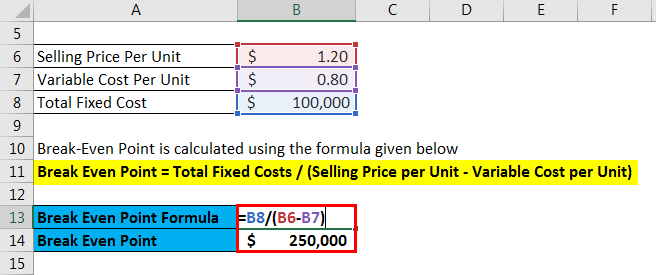

The Break Even Calculator uses the following formulas. Q is the break even quantity F is the total fixed costs P is the selling price per unit V is the variable cost per unit. The Early-2017 Guide to Buying a Home March 10 2017.

Required Income This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. This is true even if the new mortgage is secured by your main home. Do a Break-Even Analysis.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. This mortgage points calculator assumes that youll roll the cost of your points into the mortgage. There are a few ways you can improve your mortgage amount.

Q F P V or Break Even Point Q Fixed Cost Unit Price Variable Unit Cost Where. Break Even Point Formula and Example. Learn how to use our mortgage calculator to determine your monthly mortgage payments including PMI taxes insurance down payment interest rate and more.

Using the Mortgage Points Break-Even Calculator. The results will show you how long you need to stay in your home to make the refi worth it. Best Car Insurance Companies We break down rates deductibles policy info and reviews.

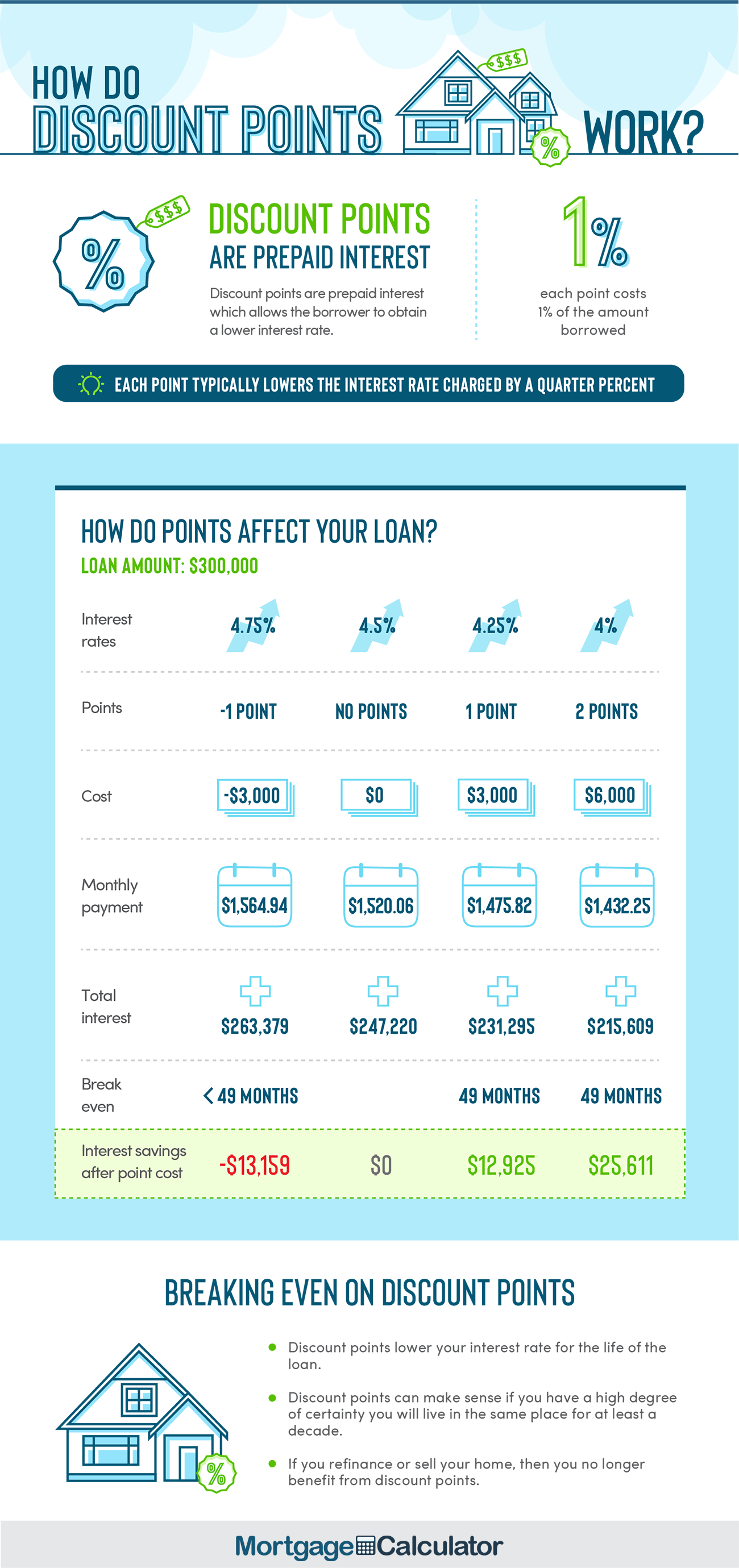

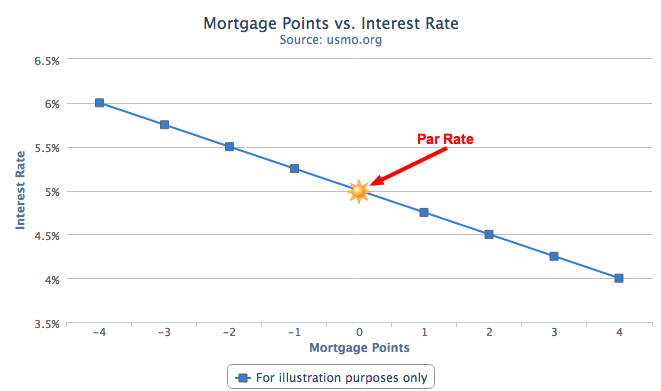

Discount points - a form of pre-paid interest which gives you a lower interest rate for the remainder of the loan. The break-even point is when the price of your refinance equals the savings from the lower interest rate. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time last week.

Required Income Calculator for a Mortgage Calculator. Break Even Points in Dollars. The Break Even point is 250 units.

Straight to the Point Valuations. The all-in-one mortgage calculator is available for download on the Play. Origination points - fees that are charged by a mortgage broker or lender for the origination of the loan.

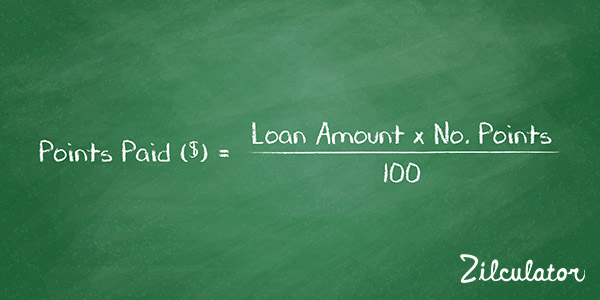

Each discount point costs 1 of your loan size and it typically lowers your mortgage. Purchasing the three discount points would cost you 3000 in exchange for a savings of 39 per month. Lets look at how mortgage payment calculators break down your monthly mortgage.

Giving you the feedback you need to break new grounds with your writing. Thats the point when youve paid off the cost of buying the points. Dont include points mortgage insurance premiums or any interest paid in 2021 that is for a year after 2021.

Our calculator includes amoritization tables bi-weekly savings. They include making a larger down payment making smarter decisions as to the neighborhood where you are looking to buy from and trying to reduce. Other things to know about mortgage points The terms around buying points can vary greatly from lender to lender.

Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. You will need to keep the house for 72 months or six years to break even on the point purchase. Benefit From Assignment Essays Extras.

There are two types of points you can pay on your mortgage loan. Enter the total cost of the mortgage with points in the box marked Mortgage amount The calculator will determine the size of the loan without points for comparison. It gives the total amount of sales in order to achieve zero loss or zero profit.

You can even get a. The calculator works. Here comes the tricky part.

The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040. In the example each point would cost 2000 because 1 of 200000 is equal to 2000. The Should I buy mortgage points calculator determines if buying points pays off by calculating your break-even point.

Calculate how much you still owe with the mortgage balance calculator. In the examples shown in the table above financing the points would take the break even point from 49 months to 121 months for the loan with 1 point 120 months for the loan with 2 points. Determining whether you should pay points on your loan.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. The Break Even formula in sales in dollars is calculated by sales price per unit into Break Even point in units. If after using the maximum mortgage calculator you find that you have a mortgage value lower than what you would have liked do not fret.

Check out the webs best free mortgage calculator to save money on your home loan today. Mortgage points could be a worthwhile solution to potentially high mortgage payments since they can only be bought before taking on a. 4 Those costs.

Points also called mortgage points or discount points are fees used to buy down your rate.

Break Even Analysis Formula Calculator Excel Template

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Discount Points Calculator Mortgage Calculator

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator

Mortgage Points A Complete Guide Rocket Mortgage

![]()

Discount Points Break Even Calculator Home Mortgage Discount Points Explained

Break Even Sales Formula Calculator Examples With Excel Template

Mortgage Discount Points Calculator Mortgage Calculator

Mortgage Points A Complete Guide Rocket Mortgage

Break Even Sales Calculator

Break Even Analysis Formula Calculator Excel Template

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Break Even Analysis Formula Calculator Excel Template

Understanding Mortgage Points U S Mortgage Calculator

What Are Mortgage Points Formula Excel Example Zilculator Real Estate Analysis Marketing

Mortgage Points Calculator 2022 Complete Guide Casaplorer